If you are looking for top traders in USA stock exchange then you are at the right place!

There are so many popular traders who moved to different careers.like Jimmy Wales who is the founder of Wikipedia and another person the 38th Prime Minister of New Zealand who is John Key.

On the other side, traders have been speculating on some major movements since the early 20th century

However, this list starts with only the legendary traders of history and those who are present now.

These are some of the best and most well-known traders in American history:

Although we are going to discuss here top 4 popular traders.

1. William Delbert Gann

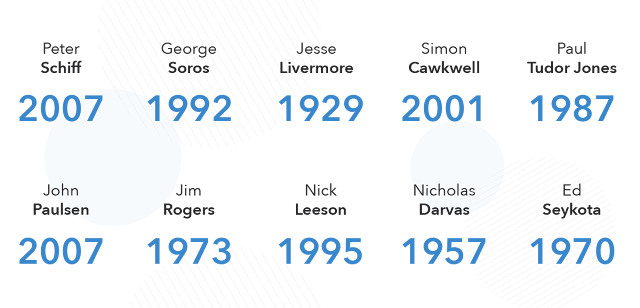

2. Jesse Livermore

3. Richard Dennis

4. George Soros

5. Jim Rogers

6.David Tepper

7. Paul Tudor Jones

8. John Paulson

9. Nick Leeson

10. Steven Cohen

1. William Delbert Gann

WD Gann from 1878 to 1955 was a trader who used market forecasting technique based on astrology, geometry, and ancient mathematics. His special technical tools include Gann fans, Gann angles, and the Square of 9, as well as trading, That time WD Gann wrote many books and courses.

By William Delbert Gann – “Time is more important than price. When time is up price will reverse.”

2. Jesse Livermore

American trader Jesse Lauriston Livermore, who lived from 1877 to 1940, was well-known for his enormous market profits and losses. He profited greatly from the 1929 market crisis, earning more than $100 million. However, by 1934, he had already wasted all of his money, and in 1940, he tragically committed suicide.

“Trade only when the market is bullish,” says Jesse Lauriston Livermore

3. Richard Dennis

Richard J. Dennis who is born in 1949 made his mark in the trading world as a highly successful Chicago-based commodities trader. From his speculation, he reportedly acquired a $200 million fortune over a ten-year period.

“Trade small because that’s where you learn from your mistakes,” says Richard Dennis.

4. George Soros

Hungarian-born George Soros was born in 1930. He is the chairman of one of the most renowned hedge fund companies, Soros Fund Management. He was dubbed "The Man Who Broke the Bank of England" in 1992 after shorting £10 billion of pounds and making a tidy profit of £1 billion.

“Making an investment decision is the same as formulating and testing a scientific theory,” says George Soros